Corporate biotech venture funding rises again

Biotech venture funding has been on a tear for the past couple of years, and corporate investors in the space are doing their part to boost the totals.

Here at Crunchbase, we’ve put together an index of the largest pharma and biotech companies active in startup investment, along with their in-house venture arms. For the second year in a row, we’re tallying their venture investments by round count and dollar totals.

The broad finding? Corporate biotech investors sharply increased the sums put into startup rounds they led in 2018. Overall, they also participated in rounds that were valued at nearly twice year-ago levels.

These aren’t small sums either. In all of 2018, corporate venture investors participated in rounds valued at $8 billion. Rounds with a corporate bio VC as lead investor, meanwhile, totaled around $1.7 billion.

Below, we drill down into a bit more detail, looking at funding totals for the past five years, largest rounds and most active investors.

As bio deals balloon, corporate VCs get spendier

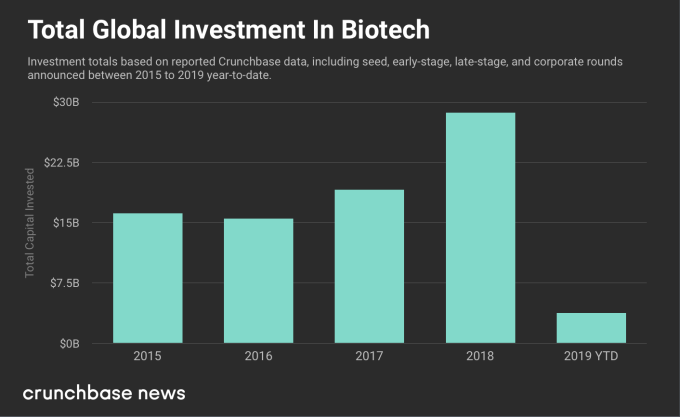

First, it’s worth noting that overall global biotech venture funding rose sharply last year and has been running at historically high levels for the past few years.

For 2018, biotech startups globally raised just shy of $29 billion in seed through late rounds from all investors, according to Crunchbase data. That’s up from $19 billion in 2017.1

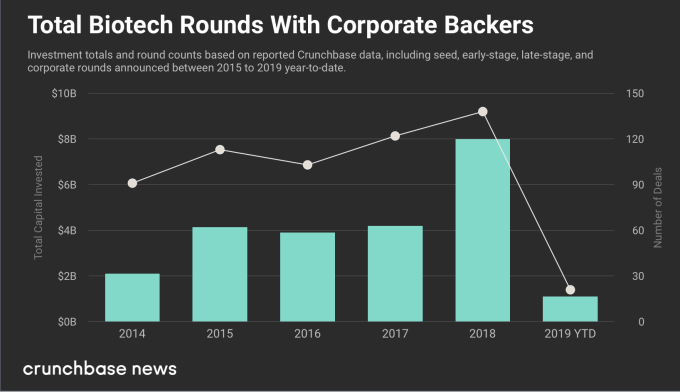

Most biotech deals do not include a corporate backer, but a pretty substantial minority do. In 2018, investors in our corporate biotech index participated in 138 seed, venture or growth-stage funding rounds, up from 122 in 2017.

Round counts did not rise as much as investment totals, as the average biotech deal has been getting bigger. The sector has not been immune from the rise of supergiant funding rounds, and deals valued in the hundreds of millions have become far more common.

That’s reflected in the funding totals. Altogether, 2018 rounds with a corporate backer were valued at $8 billion, including contributions from all investors. That’s up from $4.2 billion in 2017.

They’re leading more rounds, too

We also look specifically at bio funding rounds in which a corporate backer was the lead investor. In these cases, it’s safe to assume that the corporate investor put up a large portion, or possibly even all, of the reported funding.

For 2018, we saw corporate bio investors leading a larger number of deals, with a much larger aggregate value than prior years.

There were a few supergiant rounds in the mix. The largest was a $300 million late-stage round for personal genetic testing provider 23andMe, led by GlaxoSmithKline.

Two others were led by Celgene. One was a $250 million early-stage round last February for Celularity, a startup it spun out to focus on cancer treatments using placental cells. The other was a $101 million round last March for Vividion, developer of a proteomic drug discovery platform.

In all, corporate bio investors led at least 30 funding rounds in 2018, with an aggregate value of $1.7 billion. That’s approximately triple 2017 levels.

Active players

Of course, not all corporate bio players are equally exposed to startups. Some are far more active than others.

One example is Novartis and its Novartis Venture Fund, which has participated in 15 deals with an aggregate value of nearly $730 million since 2018. Over the past three years, it has done 40 deals, with an aggregate value of $1.6 billion.

Celgene, which agreed to be acquired by Bristol-Myers Squibb earlier this year (the deal hasn’t closed yet), is another really active venture player. The New Jersey company has participated in 30 deals valued at nearly $1.8 billion over the past three years, including 13 since the beginning of 2018.

Outsourcing innovation

The rise in corporate VC investment in pharma and biotech appears to reflect the continuation of a long-term trend toward supplementing and even supplanting in-house R&D with venture investment. Recent quarters, however, demonstrate that it’s becoming an increasingly expensive strategy, as round sizes grow and investors devote more dollars to funding hot startups.

- The numbers reported in this annual look at corporate biotech investment differ from a report on the same topic we put out a year ago. A few factors contributed to the differences, including some additions to the corporate investor list, changes in the Crunchbase data set around deal categorizations and adjustment to deal types.

Read more

March 23, 2019 at 08:33AM

from TechCrunch

via IFTTT

No comments