Personal finance startup SmartAsset raises $28M

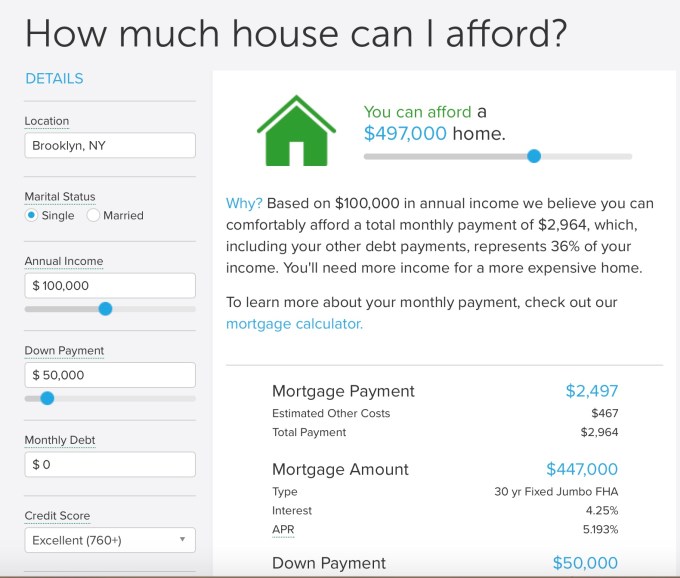

I first wrote about SmartAsset nearly six years ago, when it launched its first product, a tool allowing prospective homebuyers to analyze the rent vs. buy decision and to see what kind of home they could actually afford.

According to co-founder and CEO Michael Carvin, “On the consumer side, our strategy has never really changed. Our mission is to help people make the best personal finance decisions and to build the web’s best resource for personal finance decision-making.”

Of course, some aspects of the company have evolved. For one thing, SmartAsset now offers tools, calculators and content in a number of categories, including taxes, retirement and banking.

For another, it’s announcing today that it has raised $28 million in Series C funding, bringing its total raised to more than $51 million. The new round comes from Focus Financial Partners (a firm backed by Stone Point Capital and KKR), Javelin Venture Partners, TTV Capital, IA Capital, Contour Venture Partners, Citi Ventures, Fabrice Grinda and others.

Carvin said SmartAsset reached more than 45 million uniques last month, nearly doubling its traffic year-over-year. And 25 percent of that traffic comes from repeat visitors.

As for how SmartAsset makes money from those visitors, it does so partly by promoting financial products like mortgages. But Carvin said the biggest piece is the SmartAdvisor platform, which connects financial advisors with potential investors.

Carvin described it as “the web’s first digital lead generation platform for financial advisors,” and compared the SmartAsset business model to Zillow’s, saying both companies have built big audiences that they can then match up with real estate or finance professionals.

In SmartAsset’s case, users fill out a questionaire and then work with a SmartAsset concierge to help them find an advisor who’s a good fit. Carvin added that the advisors on the platform have been screened by the company, for example to ensure that they haven’t had any criminal violations and that SEC hasn’t upheld any complaints against them for the past decade.

Asked whether this focus on financial advisors has led SmartAsset to change the way it designs its consumer products Carvin said, “We believe the better the user experience, the better our business will work. And so when we’re building a retirement tool, a home affordability tool, a tax tool, we’re building that only with the consumer interest in mind.”

Looking ahead, Carvin said he plans to continue following this strategy.

“We’re going to build out the web’s premiere personal finance resources and then leverage that on advisor side,” he said.

Read more

June 19, 2018 at 09:34AM

from TechCrunch

via IFTTT

No comments